Ray Dalio’s Pure Alpha posted gains of 14.6% in 2018, which represented stella returns bearing in mind that all the major stock indexes ended the year in the red.

Ray Dalio’s Pure Alpha posted gains due to the billionaire hedge-fund making a 180-degree turn on his early call

Some of you may recall Ray Dalio saying back in January 2018 that a market surge may be ahead: “If you’re holding cash, you’re going to feel pretty stupid” said Ray Dalio.

“If you’re holding cash, you’re going to feel pretty stupid”

RAY DALIO – January 2018

Speaking in Davos last year Ray Dalio said, “we are in a beautiful goldilocks period right now, we are having a beautiful deleveraging, inflation is not a problem, growth is good, everything is pretty good with a big jolt of stimulation coming from tax laws”.

Then just a few weeks later in February stocks experienced a mini-crash leaving Ray Dalio with egg on his face and no doubt nursing some heavy losses too.

So even the grandmasters of the game sometimes get it wrong, financial markets have a way of making even the best of the best feel humble at times.

There is a lesson to be learned from Ray Dalio’s Pure Alpha posted gains in 2018

The art of investing/trading is not about being right all the time instead it is more to do with not staying wrong and racking up big losses for you or your investors.

The grandmasters of the game posses two rare traits, yes they have brilliant agile intellects, they are able to see with their mind’s eye (a third eye) what other cannot but they are also humble. These two traits in an investor are rare.

George Soros, billionaire investor famously said, “I’m only rich because I know when I’m wrong”.

“we are in a beautiful goldilocks period right now, we are having a beautiful deleveraging, inflation is not a problem, growth is good, everything is pretty good with a big jolt of stimulation coming from tax laws”

RAY DALIO – Davos 2018

Ray Dalio’s Pure Alpha posted gains in 2018 was due to the hedge-fund manager accepting his wrong call in January and making amends to his portfolio accordingly

Perhaps it was Ray Dalio’s war with China view that was the first indication that the hedge fund investors had turned bearish on risk assets.

Like so many other investors Ray Dalio calculated that a rise in protectionism between the two heavyweight economies would be detrimental for global trade.

Ray Dalio’s tweeted in July 2018 that: “Today is the first day of the war with China”. I wrote, “why did Did Ray Dalio leave out the word trade and wrote instead war with China?”

So let’s see how these China-US trade talks evolve. Hope for the best but plan for the worse might also be prudent. Pure Alpha’s portfolio was more orientated towards short bearish positions in the second half of 2018.

Deteriorating Sino-US relations, the Fed unwinding its massive 4 trillion USD balance sheet and hikes in the Fed fund rates weighed on markets in 2018, thereby making bearish funds profitable.

Pure Alpha posted gains in 2018 of nearly 15% is an impressive performance particularly during challenging market conditions.

“The average hedge fund dropped 6.7% in 2018, according to the HFRX Global Hedge Fund Index”

Many star hedge fund managers were struggling to turn a tidy profit in 2018

Pierre Andurand suffers heavy losses following the recent oil rout in crude prices.

Crispin Odey’s surprise losses also came in December when the London based hedge fund manager reported that his profits more than halved at his boutique investment house.

So stocks and commodities were so volatile in 2018 that even the big-name hedge fund managers were struggling.

David Einhorn’s Greenlight Capital has the worst year since its inception and Bill Ackman, industry veteran also posted a disappointing performance for the year. For billionaire investor David Einhorn, 2018 was even more depressing.

His Greenlight Capital lost 34% last year following a 9% drop in December, the worst since he started the hedge fund in 1996, according to CNBC.

The average hedge fund dropped 6.7% in 2018, according to the HFRX Global Hedge Fund Index.

So Ray Dalio’s Pure Alpha posted gains of 14.6% in 2018 means that the billionaire investor managed to buck the trend. Ray Dalio’s Pure Alpha not only beat the indexes and prevented losses for his investors he also outperformed his fellow titan hedge fund managers.

No doubt the likes of David Einhorn, Pierre Andurand and perhaps to a lesser extent Crispin Odey are all green with envy.

Ray Dalio’s Westport, Conn. based Bridgewater, is the world’s largest hedge fund with $160 billion in assets under management. Ray Dalio’s Pure Alpha fund has lived up to its name by being a consistent out-performer. Pure Alpha has been returning double-digits, on average, over its 28-year history.

“Ray Dalio’s Pure Alpha posted gains of 14.6% in 2018 means that the billionaire investor managed to buck the trend”

Ray Dalio’s Pure Alpha posted 14.6% for 2018 and many in the industry are wondering how did Ray Dalio steer his fund to profitability in a challenging market where his peers were losing money

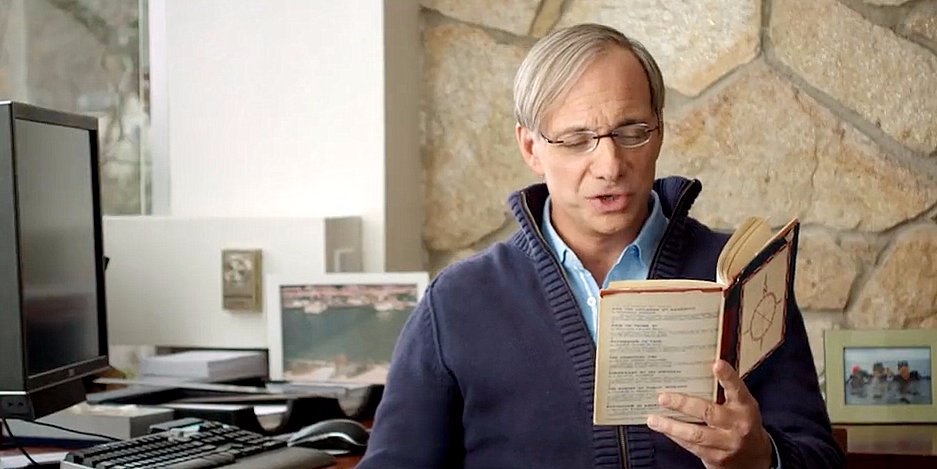

If Ray Dalio’s books are any indication then perhaps the billionaire hedge fund manager ask himself a simple question: How do I know I am right?

What Ray Dalio does that is different to other hedge fund managers is that he questions himself all the time with “how do I know I’m right?”

Another Ray Dalio strategy is to examine what happened in history where a current similar situation has occurred. How far back in history does Ray Dalio go?

According to Ray Dalio, he goes back about 500 years in economic/political/cultural history to see whether something similar (debt crisis, tulip mania, etc) has happened and what the outcome was. Ray Dalio then adjusts his strategy accordingly.