Peter Schiff advocates austerity, believing that the federal government is in a borrowing debt death spiral and trapped, potentially leading to a currency collapse.

He argues that the 2023 treasury bond market crash, worse than the Great Depression, was a shot across the bow, warning that the current public debt is on an unsustainable trajectory.

Fed chair Powell sees eye to eye with Peter Schiff’s advocates austerity view

Top senior US monetary policymakers are no longer sugarcoating a public debt crisis supporting unsustainable public spending.

Last year, on December 4, 2024, Powell warned the US is on an “unsustainable” fiscal path and called for a course correction.

“Top senior US monetary policymakers are no longer sugarcoating a public debt crisis supporting unsustainable public spending”

PETER SCHIFF

Peter Schiff advocates austerity to protect the USD from turning to junk

As an advocate of the Austrian School of Economics fostering individualism and free markets, Peter Schiff believes the government should embark immediately on an austerity programme.

He believes unsustainable government spending, soaring national debts and long-term consequences of Fed policies could lead to hyperinflation and a currency collapse.

Social Security payments will not be worth anything in a monopoly money scenario.

Best of a worse situation, Peter Schiff advocates austerity

Peter Schiff thinks the US is heading towards a severe economic crisis driven by fiscal irresponsibility.

He recommends immediate corrective action to prevent a collapse, which could be far worse and more painful.

Peter Schiff believes the government is in a vicious cycle of borrowing, continually taking on more debt to service past obligations.

Peter Schiff flags rising interest rates as a further headwind, making debt servicing even more burdensome.

Interest payment on the 36.6 Trillion dollar national debt has hit the one Trillion dollar milestone.

“The cost of this debt will only increase, leading to a scenario where tax payments receipts pay interest rather than fund essential services,” said Peter Schiff.

“The cost of this debt will only increase, leading to a scenario where tax payments receipts pay interest rather than fund essential services”

PETER SCHIFF

US Debt Clock has a new addition, the DOGE clock, which is doing its bit to reduce the debt.

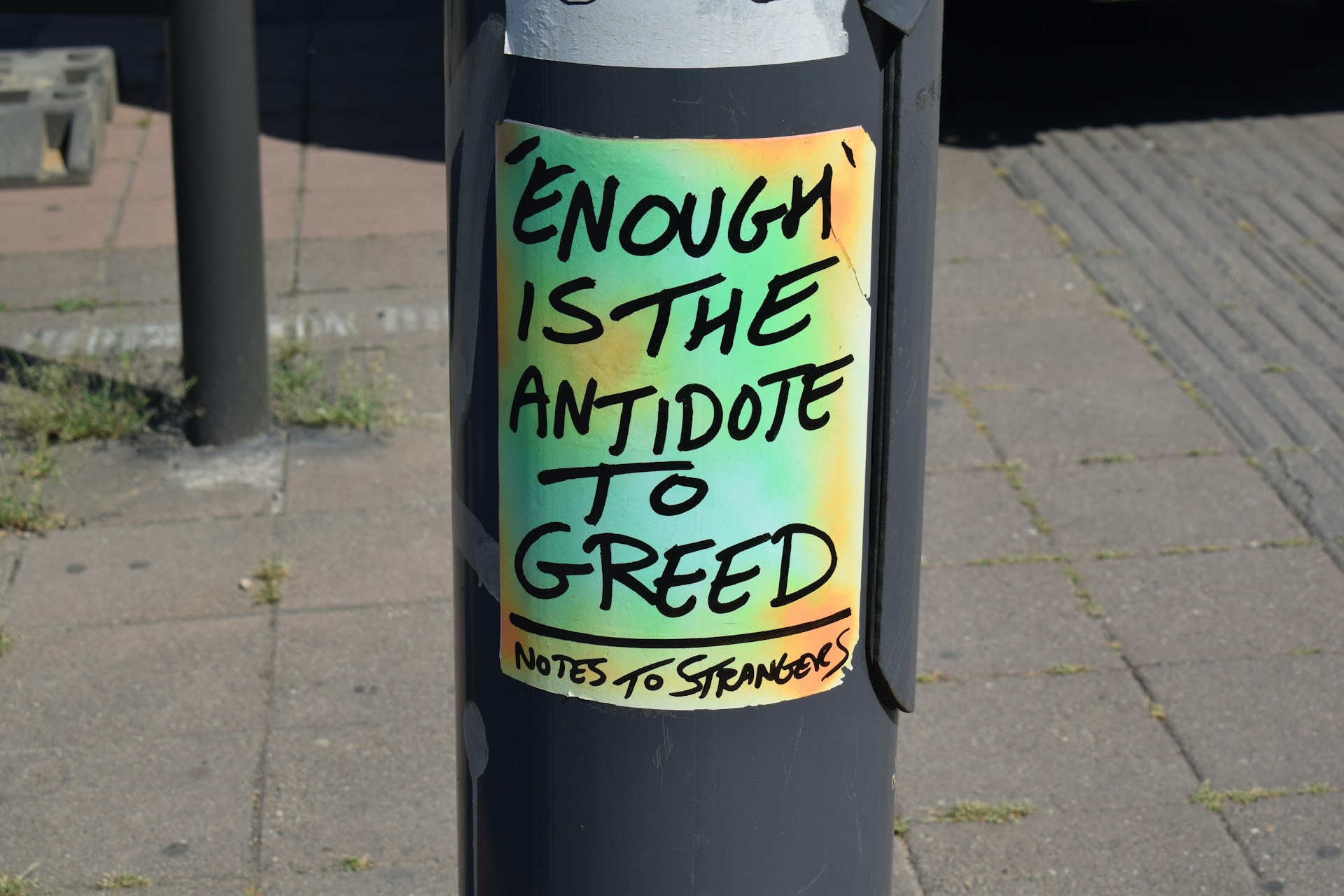

If austere hard times lie ahead, what is the breaking point of a society?

Hard times test relationships, marriages, families and the social fabric that keeps nations united.

How much hardship can the populous take before the nation comes apart, leading to social unrest and potentially civil war?

The hundred-pound gorilla in the room, what if DOGE splits the Union apart?

Back on track, Peter Schiff advocates austerity to solve inflation

Peter Schiff recommends immediate austerity to tackle inflation.

He argues excessive government spending, combined with monetary policy to monetise debts led to persistent erosion of the dollar’s purchasing power.

The outcome for many has been a cost-of-living crisis.

Peter Schiff believes the Fed is the primary cause of US economic instability with its unsound money, causing inflation and financial bubbles.

“He believes interest rates will go up, and the treasury will be unable to make interest payments on the treasuries” – Wealth Training Company

Before arriving in paradise, Peter Schiff advocates austerity

“Before we can get to the promised land, we have a few years wandering in the desert and here is what we have to do;

Cut social security, Medicare, and government pensions, many people will not get social security,” he said.

Peter Schiff recommends privatizing money and wants interest rates determined by the free market, not a monetary policy committee, which he refers to as a central politburo.

Peter Schiff advocates austerity, higher interest rates with bondholders getting haircuts

He believes interest rates will go up, and the treasury will be unable to make interest payments on the treasuries.

Peter Schiff recommends the US restructures its debt.

He advocates treasury bondholders get short-changed in debt restructuring.

Peter Schiff thinks treasury bondholders should get something but not 100 cents on the dollar, and he suggested 30 cents on the dollar.

So Peter Schiff thinks bondholders should get a haircut, which is the difference between the actual due amount and the amount that the borrower pays, and it differs from a write-off where the investor gets nothing.

Peter Schiff thinks the US had a strong economy in the 18th century due to the US having a small government.

He believes tariffs back then did not contribute to the strong economy. “Today, the government is much bigger because of the income tax,” he said.

“You can’t bring back manufacturing without finance” – Peter Schiff

“All the money collected on tariffs comes out of the pocket of consumers it is like a sales tax,” he added.

Peter Schiff noted that even if the US onshore its manufacturing, it would require significant capital to purchase land and materials to build factories, train the workers and robots.

“You can’t bring back manufacturing without finance,” he said.

“Factories also need supply chains, and to recreate the industrial base we don’t have will take many years, maybe a decade and a huge sacrifice.

It will take a lot of resources, meaning we need to stop spending and start saving, which means higher interest rates, lower asset prices and a steep recession,” he added.

Peter Schiff advocates austerity, while the current administration talks of a golden age

Nobody is preparing for hard times. Trump is talking about a golden age. We will have a steep recession very quickly,” he said.

He then asks “are they going to stick it out or cut rates and return to stimulus print money because of the recession?”

“That is going to send already soaring inflation through the roof.

If we don’t do anything, we are going to wipe out the dollar and destroy the savings and the financial assets of generations of Americans,” he added.

“That is worse than cutting social security because if we wipe out the dollar, the social security cheques have no value. So even if you are poor and depend on social security, you have nothing,” said Peter Schiff.

Peter Schiff advocates austerity not as an option but as a necessity

He suggests that the government cut spending and the budget and gradually restore confidence in the US dollar before the economy reaches a breaking point.