Martin Armstrong is a top trend forecaster/investor and he is bucking the bearish view in stocks, which has since February been gaining traction amongst a number of heavyweight investors.

“Our model is showing that we (the Dow) should reach 30,000 40,000 level at least by 2020 as Trump’s tax plans go through” said Martin Armstrong in an interview.

“Our model is showing that we (the Dow) should reach 30,000 40,000 level at least by 2020 as Trump’s tax plans go through”

MARTIN ARMSTRONG

Martin Armstrong’s bullish stocks call was made prior February’s early sell-off. Since then stocks have been struggling for direction. Moreover, a number of successful market pundits, such as Jim Rogers, have come out and said that we are on the cusp of a bear market.

But Martin Armstrong’s contrarian view which bucks the bearish view in stocks is (as usual) provocative and somewhat intriguing because it turns the bearish view on its head.

Martin Armstrong sees higher inflation coming. “Interests rates will go up faster than any time in history, you re looking at doubling interest rates very rapidly between 2018 and 2021”.

But surely higher Fed fund rates will inevitably eat into the corporate “profit pie”, particularly those which are highly leveraged as it raises the cost of servicing debt. So if inflation bolts out of the trailer like a wild horse then the Fed will indeed be forced to tame it with higher interest rates.

“Interests rates will go up faster than any time in history, you re looking at doubling interest rates very rapidly between 2018 and 2021”

MARTIN ARMSTRONG

In short, if sharp Fed rate rises are on the card (Fed Powell has already announced his intention to raise rates three times in 2018) then Fed tightening will inevitably eat into corporate profits and likely be a drag on investments too.

So how can that be good for stocks, bearing in mind that higher inflation and accompanying Fed rate hikes supports a bearish stance on stocks?

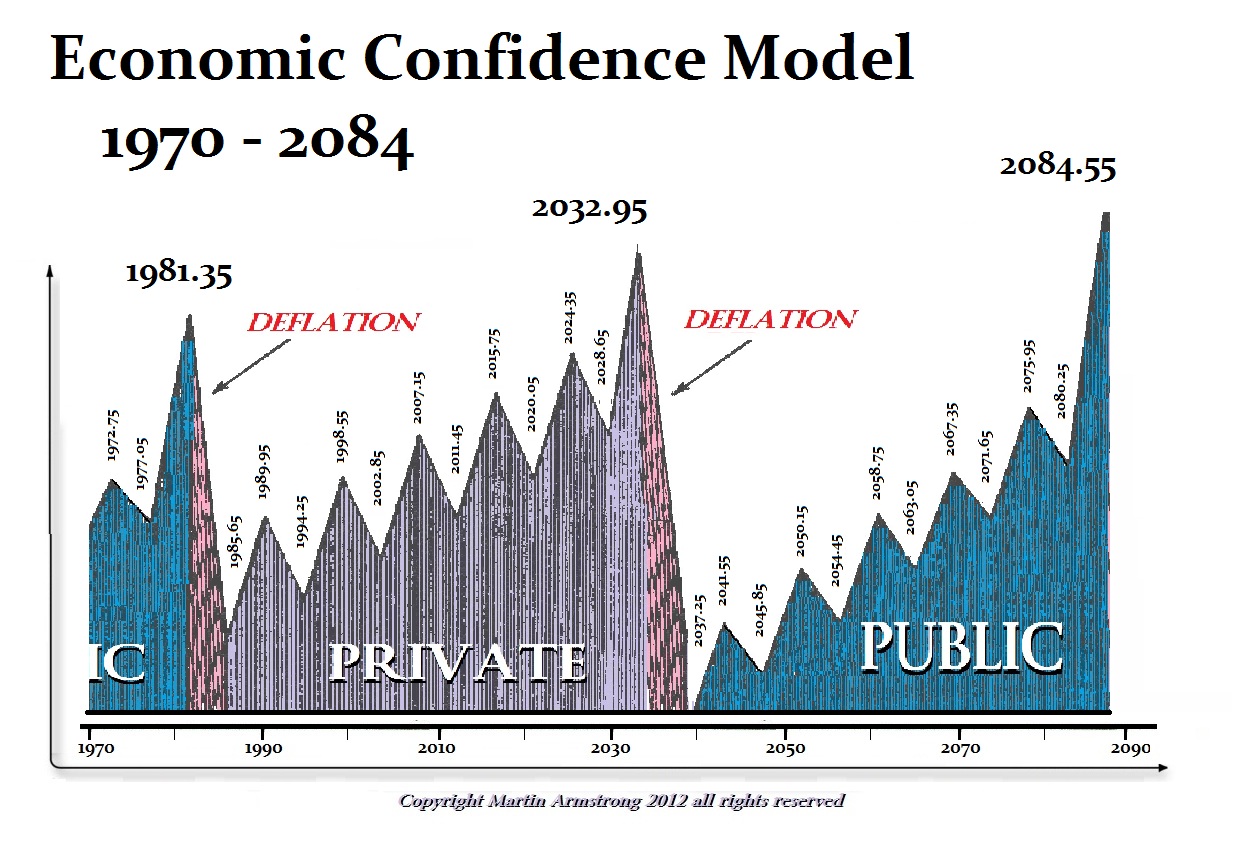

The crux of Martin Armstrong’s bullish view which bucks the bearish view in stocks is centered around the rotation of capital from the public (government) to the private (corporate) sector.

In other words, Martin Armstrong believes that bonds are in the biggest bubble in history. But he stresses that it is more of a bond bubble rather than a stock bubble. So as investors rotate out of bonds and into equities that could fuel the next leg of the bull market, thereby bucking the Dow to 30,000 40,000, argues Martin Armstrong.

But in a high inflation, interest rate environment why would investors flee into equities?

The opportunity cost of holding precious metals (gold, silver) is the interest rate foregone when holding cash in a deposit account. So precious metals become less attractive when the central bank is tightening.

“Two of our big pension fund clients have dumped government bonds” – Martin Armstrong

What about real estate?

“You have got to be careful with Real estate because local governments can keep raising taxes” said Martin Armstrong.

Moreover, the sovereign (government) bond bubble is the bubble of all bubbles, according to Martin Armstrong.

Martin Armstrong cites almost ten years of the major central bank buying government debt, better known as quantitative easing, to keep insolvent governments afloat during the financial crisis of 2008 as the main reason for sovereign bonds being in a massive bubble. “Two of our big pension fund clients have dumped government bonds” said Martin Armstrong.

The top trend forecaster/investor who also advises governments sees a continuing rotation of capital from the public to the price sector.

“Corporate debt is infinitely better” said Martin Armstrong. “If a triple AAA company goes belly up you have got assets to sell,” explains Martin Armstrong. “When a government defaults, investors get a hair cut-you cant go down to local art museum and lift a Picasso. Central banks have kept governments on life support – they were just buying government bonds” added Martin Armstrong.

“Stocks have tended to rally during war periods” – MARTIN ARMSTRONG

So Martin Armstrong’s bucking the bearish view in stocks is based on the simple fact that investor will have nowhere to hide during rising inflation and interest rates other than corporate bonds and equities. He sees a rally in private sector assets (stocks and corporate bonds) with solid cash flows and low debt levels because there is simply is nowhere else for investors to shelter from the duo of rising inflation and higher interest rates.

“In the US Share Market, this is now a turning point we have reached. I have warned for months that exceeding the November high would lead to a January high. Now, the failure of February to make new highs warns of a March low. The support for a correction now lies at the 25637 level on a weekly closing basis (this is not a reversal),” said Martin Armstrong.

Another reason why Martin Armstrong’s bucking the bearish view in stocks is the pro business-friendly Trump administration. The Trump tax cuts and infrastructure spending reduce significantly the odds of a US recession in 2018.

What about a potential trade war, surely that will end the bull market?

On the one hand, Trump’s domestic economic policy is a winner. But “companies in the Standard & Poor’s 500 index got 43% of their sales from outside the country in 2016, Some see a trade war will kill earning and cause the crash.” But Martin Armstrong isn’t too concerned as domestic consumption will kick in.

What about geopolitical uncertainty, could that kill the bull market? What if Trump’s stance in North Korea leads to war. “Stocks have tended to rally during war periods” said Martin Armstrong. Moreover, regarding rising inflation that will just accelerate the rotation of capital out of the public to private sector, he argues.

So what is the real risk, according to Martin Armstrong?

“This risk is IMPEACHMENT and nobody seems to consider that factor.

Trump’s Tax Reform has forced other countries to look at how their tax systems are not competitive either. All of that will be reversed and it is clear this is what the Washington elite want like Lindsey Graham” Martin Armstrong.

So Martin Armstrong is bucking the bearish view in stocks. However, the big risk he sees is the removal of Trump by the Washington elite.

Want the latest investor news as it happens?

Subscribe to our Investors Newsletter