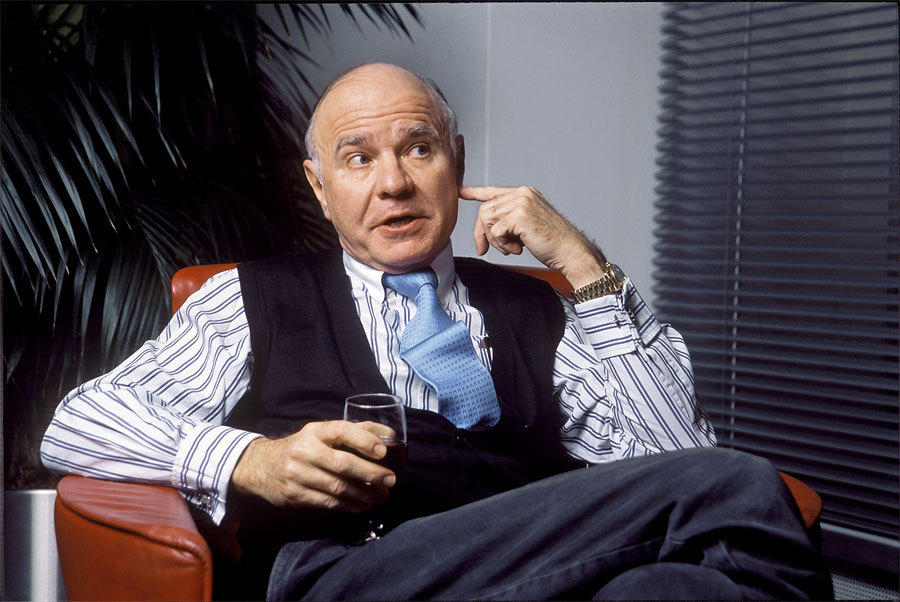

Marc Faber shed light on several hot button topics in his latest interview.

Lockdowns, the spiraling government debt, inflation, and the future of the reserve currency, the USD, were all discussed by Marc Faber, who is known as the publisher of the Gloom Boom & Doom Report.

Needless to say, Marc Faber is concerned about the current state of affairs relating to society and the economy.

I have read about the history of the Third Reich, and some commentators have explained exactly how it happened step by step,” said Marc Faber.

“Marc Faber is concerned about the current state of affairs relating to society and the economy”

WEALTH TRAINING COMPANY

Marc Faber concluded that free democracies are tiptoeing towards totalitarianism, which is being normalized. “The infringement of people’s lives and freedom has never happened before in human history,” said Marc Faber.

Marc Faber then referred to German Lutheran pastor Martin Niemöller (1892–1984)

“First they came for the socialists, and I did not speak out because I was not a socialist.

Then they came for the trade unionists, and I did not speak out because I was not a trade unionist.

Then they came for the Jews, and I did not speak out because I was not a Jew.

Then they came for me, and there was no one left to speak for me.”

“The infringement of people’s lives and freedom has never happened before in human history”

MARC FABER

Moving onto inflation, Marc Faber shed light on the 10-year treasury yield, which he believes will remain suppressed

“The 10-year bond yields for last two years has been below two percent the inflation in those days was approximately 2 to 3 percent, so it was mildly negative interest rates in real-term inflation-adjusted.

“But now according, to the government, inflation is running at approximately 4%. But these are government figures,” he said. Meanwhile, private-sector cost of living figures shows that the real cost of living is running somewhere between 5 and 10%, noted Marc Faber.

“Housing prices are up 18%,” he said.

“The polarity in economics and living standards is contributing to greater political polarity. It is also leading to reduced trust and confidence in government, financial institutions, and the media, which is at or near 35-year lows” – Ray Dalio

Marc Faber also noted that Government spending is spiraling.

“People sit at home happily receiving cheques from the government, but the last thing people ask themselves is where is the money coming from,” he said.

So here is the answer in a chart which shows Federal Reserve assets over the years. Fed’s total assets were 4.1 T dollars in January 2020, and in August 2021, it is 8.4 T dollars.

“The big threat to asset prices is when interest rates will go up” – Marc Faber

Marc Faber shed light on the main risk to asset prices

“The big threat to asset prices is when interest rates will go up,” he said. So Marc Faber thinks that the Fed will keep the 10-year yields suppressed.

“If the markets were not manipulated, the 10-year treasury would be yielding something like 5%,” he said.

The treasure 10 years is the yardstick for global borrowing rates. Rising yields impact the cost of financing global debt. Moreover, nearly every asset price is determined by the cost of borrowing, bearing in mind most assets are purchased with borrowed money. So as borrowing costs rise, that negatively impacts asset prices.

Because the system is so indebted, any material change in yields prices could collapse asset prices.