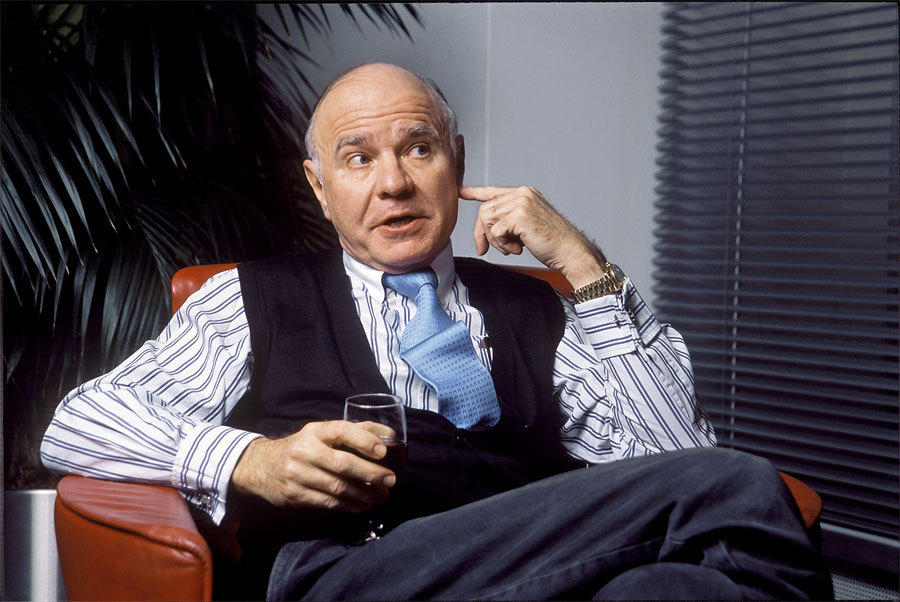

Marc Faber shares his frank views in his latest interview and as usual, nothing is sugar-coated as he tackles heavyweight geopolitical and investment challenges of the day punctuated by his all-familiar belly laughs.

“I am deeply concerned about the quality of the bureaucrats that we have in the Western world in the US and especially in Europe,” he said.

“The quality of our leadership is a disaster if you compare it to the great presidents the US had in the 19th century, then we have had in the last 20 years completely incompetent characters,” he added.

“I am deeply concerned about the quality of the bureaucrats that we have in the Western world in the US and especially in Europe”

MARC FABER

Policy incompetence, Marc Faber shares his frank views believing that common sense is lacking amongst policy makers of our era

“Policies based on some ludicrous ideology,” he said, hinting towards Modern Monetary Theory MMT.

He recalled Germany in the 50s, known as the miracle economy and he noted the country did well in the 1980s and 90s noting that the country had an intelligent central banker who made policies with common sense.

“Now in Europe, we have all these money printers,” he said.

He argues that central bankers have become data-dependent interventionalists.

Marc Faber shares his frank views about a politicised Fed and MMT

“The current Fed chair is motivated by politics, he desires to have the Democrats elected at all costs to avoid Trump winning the elections.

It seems the Fed chair and the US Treasury Secretary are the same. If you take the deficit away, there is no economic growth,” he said.

“Now in Europe, we have all these money printers”

MARC FABER

“MMT argues that deficits don’t matter,” he said.

But MMT is a subset of Imperialism. Deficits don’t matter when you are the hegemon, where the world needs your currency to buy oil and conduct international trade, and where rules are made by you.

Deficits don’t matter if the US dollar is the world reserve currency, where everyone stores their surplus wealth in USD demand or US paper, Treasuries, will remain buoyant. WW3, the mother of all wars, could sadly be inevitable because a threat to the USD is an existential threat to an economic model based on debt. US public spending accounts for 37% of the economy. Moreover, there are 80 trillion US dollars of unfunded liabilities. The situation in the EU is even more debt-dependent, with 50.5% of the eurozone economy supported by public spending.

“As an investor, I don’t care how much they (central bankers) print because it is our duty as fund managers and investors to find the sectors that will go up and down” – Marc Faber

If the debt model collapsed, countless millions of people would starve to death. A systemic collapse of the debt model would make The Great Depression of the 30s look like a picnic, bearing in mind people were more resourceful then.

Central banks are bankrolling governments and keeping countless businesses and people alive. If this debt model, with no reverse gear, collapses, a lawless Mad Max scenario would play out, and the rise of demagogues and a likely civil war would follow.

The puppet masters may have realised the end game is nearing, that a debt system with no reverse gear is destined to crash.

Facing two dire choices, a financial collapse, biblical depression and an off-with-their-head type of civil war or WW3 and a likely nuclear war, the latter may have been chosen as preferable by the Western masters.

Think about it. Western elites are more likely to survive WW3 than a civil war.

It explains why Mark Zuckerberg, who rubs shoulders with Washington policymakers, sold a chunk of his stock to build a 187 million-dollar secret bunker in Hawaii.

The puppets on the global stage are not pulling the strings, so they don’t need to be intelligent, they just get on the stage, read the script and not divert from it.

How to invest in these disturbing times?; Marc Faber shares his frank views

“The guiding principle as an investor is not to trust politicians and central banks. They are all liars and have misled the public throughout the period that they have been in office,” he said.

He recommends owning precious metals as a hedge in a nefarious system.

“As an investor, I don’t care how much they (central bankers) print because it is our duty as fund managers and investors to find the sectors that will go up and down.

Money in the bank never pays sufficient interest and is below the cost of living increases,” he said.

He is an advocate of gold, but he is also a realist. US President Executive Order 6102 required US citizens to sell gold to the government below market rate.

He previously made huge losses shorting and now refuses to do it and prefers cash. The further the economy deteriorates, the greater the money printing, so the stock market keeps rising.

He doesn’t believe inflation is over and advocates governments cutting spending by 50% but realises it won’t happen.

“Latin America looks reasonably attractive. I have money in Latin America as a hedge if it comes down to WW3” – Marc Faber

Marc Faber shares his frank views about perpetual money printing

“Over the past few years, the cost of living for most households has gone up between 15 and 25%,” he said.

“In all societies, whether Roman Babylonians or Greeks, they eventually printed money because it was the least painful,” he said.

Marc Faber believes that cash deposits at banks are not safe

Home prices have gone up much more than cash deposits.

Marc Faber has property investments in Switzerland and also in other countries.

He keeps his gold in Switzerland in safe deposit boxes.

He has a portfolio of resources in Canada, which includes some gold shares. Marc Faber has a portfolio of Asian property stocks.

Marc Faber thinks an unusual opportunity has arisen in Hong Kong, where property stocks have no leverage.

Families own properties with zero debts and frequently sell at a 60% discount to asset value. Marc Faber thinks HK will become an important city in China. He also owns US treasury bonds.

“Latin America looks reasonably attractive. I have money in Latin America as a hedge if it comes down to WW3,” he said.

What worries him most about the US is the disregard for saving money and spending.

Marc Faber believes we are in a silent depression, and he is not ruling out that it starts with deflation, which is why he holds treasuries.

He believes wealthy Western families don’t have enough exposure to the developing world.

“88% of the population lives outside the US, EU and NATO,” he said.

Want the latest investor news as it happens?

Subscribe to our Investors Newsletter