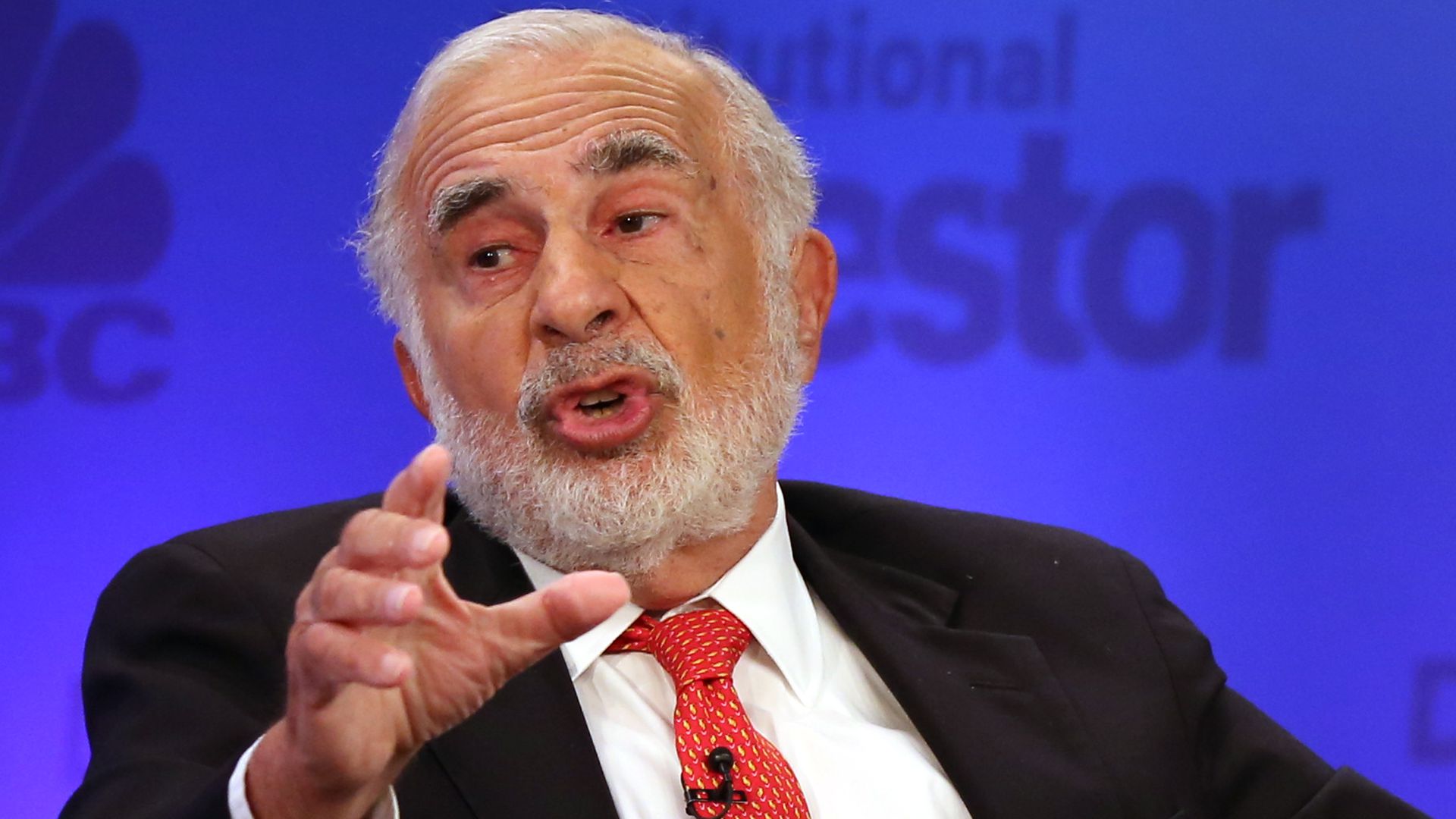

Carl Icahn lost billions on his bearish wagers going back as far as 2016. A lot of companies are “way overvalued,” said Carl Icahn in 2017.

But the difficulty with determining the value of something is it is priced with currency, which exchange value and purchasing power fluctuations according to central bank liquidity.

If an investor measured his waist using a tailor’s tape measure in 2017, then again in 2023, and the difference was four inches more, then he/she gained weight, which is an empirical fact.

“If an investor measured his waist using a tailor’s tape measure in 2017, then again in 2023, and the difference was four inches more, then he/she gained weight, which is an empirical fact”

WEALTH TRAINING COMPANY

But is the same investor more prosperous if he/she bought Venezuelan stocks in 2018, bearing in mind the Venezuelan stock market had a stellar performance up over 73000% in the previous year?

The investor accumulated more bolívar, but purchasing value and exchange value of the portfolio, in bolivar measured in US dollars and gold, were not so impressive.

In other words, inflation makes investors appear successful, and for those with debts, it also erodes the burden of paying those debts. Moreover, because inflation increases the portfolio’s value in terms of currency, the State collects more revenue in capital gains tax. Put simply, shorting a market is betting against a system rigged to the upside, and it is a bet that often ends in losses. If there are no investors, capitalism withers on the vine, and without optimism, animal spirit greed, there are no investors. The statue of Wall Street; the charging golden bull, capitalism worships the bull.

Carl Icahn lost nine billion dollars on his bearish wagers

“I am concerned about the market in the short-term,” Icahn tweeted in 2016. Carl Icahn translated his fear into bearish wagers and lost billions of dollars.

“inflation makes investors appear successful,”

WEALTH TRAINING COMPANY

Could there be a lesson learned from Carl Icahn losing billions on his bearish wagers?

In the age of central banks, basing investment decisions on fundamentals and investor sentiment alone will not give the investor a complete picture to make winning investments.

The mood in 2016 was gloomy, which allowed populist candidate Trump to campaign for the presidency on a nationalistic agenda.

Trump’s stopping the carnage of cities, bringing back to life the rust belts, and good-paying middle-class jobs resonated well with the electorate and got him into power. So there was a period when investment sentiment improved, and investors rationalised business-friendly POTUS as being good for stocks.

But it was the Fed’s accommodative monetary policy, keeping the Fed fund rates low and pumping the market with liquidity which kept the bull running.

Exhibit 1; The Federal Reserve Balance Sheet more than doubled from 2016 at 4.4 trillion US dollars to 8.9 trillion US dollars in 2022.

“Carl Icahn lost billions on his bearish wagers because he did not factor the central bank liquidity cycle into his investment decision equations”

– Wealth Training Company

With trillions of dollars of central bank liquidity in the system, that created the bubble of everything all-time highs in stocks, bonds and cryptos and real estate.

Central bank liquidity took a moon shoot in the 2020 pandemic global economic lockdowns, and stocks rallied to all-time highs.

So central bank liquidity trumps fundamentals in a central bank-driven market.

But remember what happened in December 2018, the Fed decided to make one rate hike too many, reduce QE to dampen inflation, and it was the worst December for stocks since the Great Depression.

In a central bank-driven market it is central bank liquidity which determines the trajectory of asset prices.

So, investors need to gauge where we are in the economic cycle, investor sentiment cycle and most importantly, how likely are those cycles going to impact the central bank liquidity cycle.

If an investor can forecast where central bank liquidity is likely to be in one year, then they can forecast asset price trajectory with some degree of accuracy.

So Carl Icahn lost billions on his bearish wagers because he did not factor the central bank liquidity cycle into his investment decision equations.

He may have been right about the fundamentals, deteriorating investor sentiment and the rise of political populism. But it was a costly mistake not to factor in the equation central bank liquidity cycle.

If the financial-economic landscape is dire, investors need to ask themselves how that would likely impact central bank monetary policy and the liquidity cycle.

“We are still hedged, but not to the extent we were” – Carl Icahn

Bad news can be good news when the central bank loosens monetary policy, and vice versa.

According to a Financial Times analysis, the prominent activist investor lost about $1.8bn in 2017 on hedging positions that would have paid out if asset prices had tumbled before losing a further $7bn between 2018 and the first quarter of this year.

“I obviously believed the market was in for great trouble,” said Icahn. “[But] the Fed injected trillions of dollars into the market to fight Covid and the old saying is true: ‘Don’t fight the Fed’,” he said.

As Icahn’s short bets were margin called and drained billions of dollars from his investment firm, he ploughed nearly $4bn of his own money into his publicly listed vehicle, filings show. That injection helped keep the firm’s internally calculated investment portfolio value relatively stable.

“I still to some extent believe that this economy is not good and there are going to be problems ahead,” Icahn said. “We are still hedged, but not to the extent we were,” he said.

But with the bank runs of the 2023 banking liquidity crisis and as we tinker on the collapse of another real estate bubble, the Fed’s tightening cycle could be maturing.