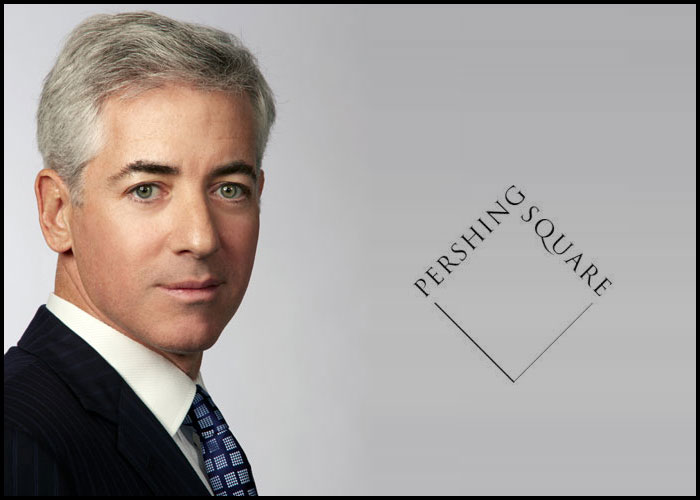

Can Bill Ackman’s restructuring lay-off plan reverse three years of straight losses at Pershing Square?

Top investor Bill Ackman’s fund Pershing Square yielded sub-par performance in 2017.

In 2017, Pershing lost 4 percent while the S&P 500 gained 21.8 percent. Moreover, the fund lost 20.5 percent and 13.5 percent in 2015 and 2016, respectively.

The poor performance of the Pershing Square fund is demoralizing for Bill Ackman, bearing in mind that the billionaire activist contrarian investor has literally been outperformed by a dart-throwing chimpanzee.

Perhaps that too is a stark reminder to investors (great and small) not to be fooled by randomness, that past performance is no guarantee of future success, that an investment strategy which is profitable today could also be loss-making tomorrow. In other words, remain humble, self-critical…

“Bill Ackman, one of the worst performing managers in the past three years will be firing almost 18% of Pershing Square staff and “looking to lower his public profile”

So why did Pershing Square underperformed and will Bill Ackman’s restructuring lay-off plan actually work?

Bill Ackman’s lucky strike came when he shorted MBIA’s bonds during the 2008 financial crisis. But the post-2008 financial crisis saw the greatest monetary easing experiment in the history of finance.

Trillions of dollars of quantitative easing programme (QE) which involved a coordinated effort by the major central banks to purchases sovereign bonds (QE even expanded to equities in the case of BoJ) flooded the system with liquidity, thereby creating the bubble in everything.

Like many hedge funds that went short and lost a fortune in the post-2008 financial world, Bill Ackman didn’t factor into the equation the main function of central banks, to maintain stability in the system.

Maybe it is not wise for traders/Investors to take their next trading tip from a Hollywood movie, (The big short) since by the time Hollywood gathers all the stars on stage it is already old hat.

“Like many hedge funds that went short and lost a fortune in the post-2008 financial world, Bill Ackman didn’t factor into the equation the main function of central banks, to maintain stability in the system”

So shorting stocks, bonds during the greatest bull market delirious on monetary stimulus, combined with the Trump trade euphoria meant that Bill Ackman’s losses where part financing (through a short squeeze) the longest bull rally in memory.For Bill Ackman it must have felt like he (his investors) were paying someone else’s honeymoon.

Then Bill Ackman tried to make it good with another massive $1 billion short bet on the nutritional supplement company in 2012, Herbalife and that too blew up.

Ackman has long maintained that Herbalife was a pyramid scheme and its stock would fall to zero.

But Herbalife’s stock rallied and Bill Ackman found himself cornered and squeezed as shares of Herbalife soared to a nearly three-year high. The maker of nutritional shakes jumped 11.2 percent, to $75.25, after it revealed its recent offer to repurchase up to $600 million of outstanding shares.

“We estimate that short sellers had a single-day paper loss of $145 million, with an 11.2 percent jump in Herbalife shares today” – Matthew Unterman, (director at financial analytics firm S3 Partners)

“We estimate that short sellers had a single-day paper loss of $145 million, with an 11.2 percent jump in Herbalife shares today,” Matthew Unterman, director at financial analytics firm S3 Partners, told The Post.

Bill Ackman’s fund also made a disastrous investment in Valeant Pharmaceuticals, which cost the fund roughly $4 billion by the time Ackman exited the position in March 2017.

Bill Ackman’s recent string of punishing losses would have been sufficient for most to be so demoralized that they would throw the towel in. Nevertheless, the former billionaire investor is literally getting on his bike (after letting go of his chauffeur). Indeed, Bill Ackman’s restructuring lay-off plan has been announced.

So Bill Ackman is back in the game but will his investors believe that his restructuring lay-off plan will actually work?

Bill Ackman, one of the worst performing managers in the past three years will be firing almost 18% of Pershing Square staff and “looking to lower his public profile”.

Bill Ackman is making a last attempt to turn around his foundering hedge fund which appears to have finally been hit with redemption requests.

“So Bill Ackman is back in the game but will his investors believe that his restructuring lay-off plan will actually work?”

Less time on stage, more time analyzing

So the former billionaire hedge fund manager will “spend more time investing and stop being the firm’s No. 1 marketer” Reuters reported citing people familiar.

The first stage in Bill Ackman’s “turnaround” entails laying off 10 people and reducing the firm’s headcount to 46 employees from 56, to oversee the roughly $9 billion in AUM it has left. Ackman’s assets AUM is still relatively large amount, however, it is half the assets Ackman managed at Pershing Square’s peak in 2015 around the time he was allegedly colluding to take over Allergan.

While most of the headcount cut involves back-office employees, one investment team member is also leaving and we can expect more to follow.

Bill Ackman will be redoubling efforts on focusing on the fund’s investment strategy and investment analysis, according to the Reuters report.

But here is the interesting bit; “Ackman also plans to go silent, at least for awhile, the people said, a major change in style for one of Wall Street’s most voluble investors.”

What happened to Bill Ackman’s firebrand of activism?

All marketing and public relations meetings associated with running a big hedge fund will also be curtailed.

The sixty-four million dollar question is whether Bill Ackman’s restructuring lay-off plan will actually work with Ackman less on stage and more in the office concentrating on financial analysis.

Bill Ackman’s restructuring lay-off plan will cut costs-but let’s be frank we are not talking about a big headcount cut, bearing in mind the fund employes less than 100 people.

Whether Bill Ackman’s restructuring lay-off plan works will depend on whether the former investor star actually learns from his previous losses and makes a Ray Dalio style comeback.

Being wrong isn’t bad if you can learn from your mistakes it’s being wrong and staying wrong that is a fast track to the poorhouse.