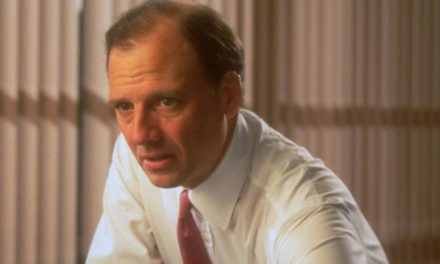

Bill Ackman was Educated at Harvard Business School, Harvard College, Harvard University.

In 1988, he received a bachelor of arts degree magna cum laude in history from Harvard College. His thesis was “Scaling the Ivy Wall: the Jewish and Asian American Experience in Harvard Admissions.”

Ackman’s most notable market play includes shorting MBIA’s bonds during the 2008 financial crisis, his proxy battle with Canadian Pacific Railway, as well as his stakes in the Target Corporation, Valeant Pharmaceuticals, and Chipotle Mexican Grill. Since 2012, he has held a US$1 billion short against the nutrition company Herbalife, claiming the company is a pyramid scheme designed as a multi-level marketing firm.

In 1992, Bill Ackman founded the investment firm Gotham Partners with fellow Harvard graduate David P. Berkowitz. This investment firm made small investments in public companies.

In 1995, Ackman partnered with the insurance and real estate firm Leucadia National to bid for Rockefeller Center. Although they did not win the deal.

In 2005, Pershing bought a significant share in the fast food chain Wendy’s International and successfully pressured it to sell its Tim Hortons doughnut chain.

Bill Ackman “practices” have also attracted criticism noticeable from former Rep. Bob Barr who called on Congress to investigate Ackman’s use of public relations and regulatory pressure in his short campaign.

Harvey L. Pitt, a former chairman of the Securities and Exchange Commission, questioned whether Bill Ackman’s aims to move the price rather than spread the truth.

FBI also investigated whether people hired by Bill Ackman “made false statements about Herbalife’s business model a company which he was shorting.

Since 2012 Bill Ackman has held a US$1 billion short against the nutrition company Herbalife, claiming the company is a pyramid scheme designed as a multi-level marketing firm

INVESTMENT STYLE

Bill Ackman is similar to Carl Icahn in that he too has a contrarian “activist” investment style which is controversial.

Ackman has been investigated by the FBI and he has been criticized by the former chairman of the Securities and Exchange Commission about his practices.

Moreover, Bill Ackman has also had his share of losses.

Following his big loss making bet on Valeant Pharmaceuticals International Ackman said, “When you put your hand in the fire and you get burned, you go back to a real focus on your core”.

The billionaire said (speaking to hedge fund managers and investors at the annual SkyBridge Capital industry conference in Las Vegas) “I’m incredibly focused. I’ve got something to prove”

I’m incredibly focused. I’ve got something to prove – Bill Ackman

LEARNING RESOURCES

Bill Ackman has given a number of interviews over the years. In the following interview and Q&A with Billionaire hedge fund CEO Bill Ackman he discusses his investing strategy, his winners and losers throughout his career. The interview also covers Bill’s early life and philanthropy.

When you put your hand in the fire and you get burned, you go back to a real focus on your core – Bill Ackman

CONNECT WITH INVESTOR

Follow this World Top Investor via their various social media channels and read more about their background and current investment interests on their official website:

Bill Ackman

www.pscmevents.com

World Top Investors Rating

88%

Summary Crunching the numbers we find out just where this investor stands in the rankings for the Worlds Top Investors!

Strategy

Net Worth

Time to Accumulate Fortune

Rags to Riches

Sharing Knowledge

Philanthropy

Want the latest investor news as it happens?

Subscribe to our Investors Newsletter