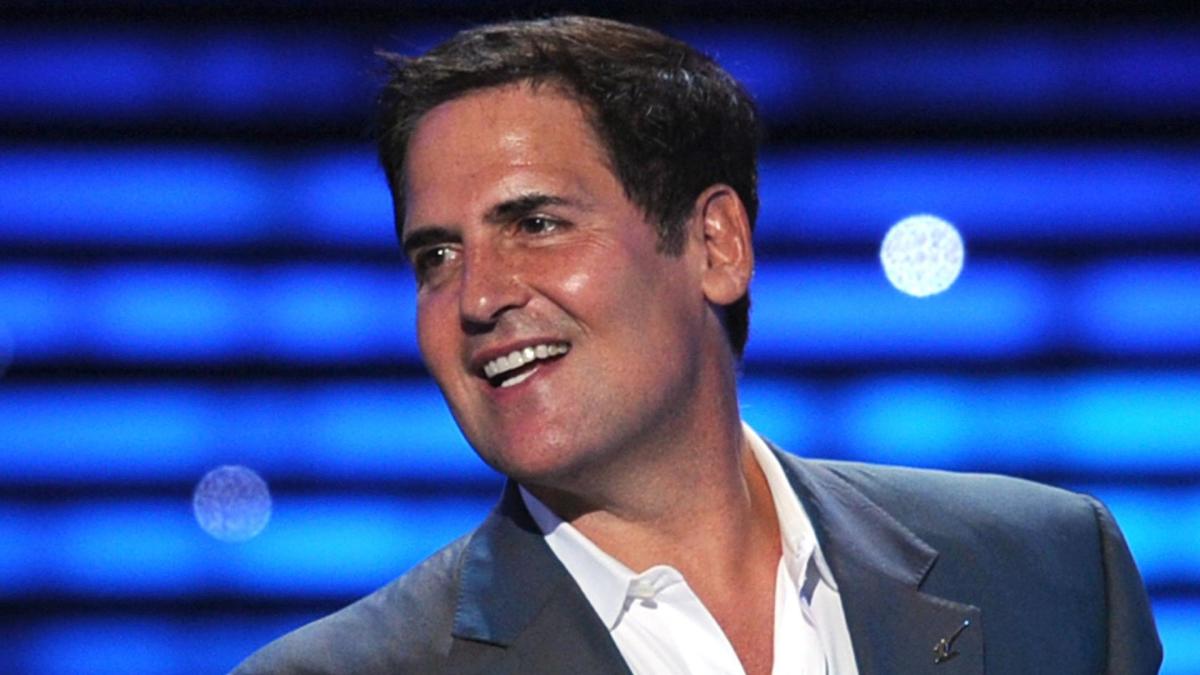

Mark Cuban flags a coming recession warning that sharp economic downturns begin with federal cuts spreading through the economy.

Keynesian contractionary fiscal policy is not the only headwind on deck, as monetary tightening in the form of quantitative tightening QT also weighs on the economy.

The Fed’s balance sheet declined by $42 billion in January, to $6.81 trillion, the lowest since May 2020.

So the Fed has now shed 46% of the $3.27 trillion in Treasuries heaped on the balance sheet during pandemic QE, as I noted in a piece entitled Rising Treasury bond Yields, posted in February.

“The Fed’s balance sheet declined by $42 billion in January, to $6.81 trillion, the lowest since May 2020”

WEALTH TRAINING COMPANY

Mark Cuban flags a coming recession, a policy-manufactured recession

Reuters notes DOGE spending cuts have led to job cuts surging 245%, or 63,583 job losses last month alone.

Moreover, QT is draining liquidity from the markets and with Q4 GDP at 2.3% and the current Fed fund rates of 4. 25 to 4.5%, those Fed fund rates are also in contractionary territory, despite last year’s 100 basis points Fed rate cuts.

At some point, rising treasury bond yields combined with unprecedented public cuts and a potentially sharp economic contraction on the cards could trigger investor interest in treasury bonds.

Maybe that is why US 10-Year Treasury Note are near three-month lows, currently at 4.229 %, as global capital flows into treasuries to shelter against a recession. But if that were the case, why did the US Dollar Index (DXY) crash 4.24% last month, bearing in mind demand for treasuries and dollars is complimentary?

“Reuters notes DOGE spending cuts have led to job cuts surging 245%, or 63,583 job losses last month alone”

WEALTH TRAINING COMPANY

Another possibility for declining treasury yields in Q1 is the Fed is buying the surplus bonds, yield targeting, suppressing yields, and doing stealth QE, which explains why the DXY is tumbling.

Mark Cuban flags a coming recession based on fiscal contraction policy having a multiplier effect

“This is a worse issue than people realize, not only are jobs lost, but their families are losing benefits and landlords are losing tenants.

Cities and towns are losing revenue.

It is how recessions start,” Cuban wrote in X about federal contractors furloughing staff and slashing pay.

“Ready Fire Aim is no way to govern,” he added,

“A recession can often result in volatility in prices” – Mark Cuban

The full fallout of DOGE has yet to be known.

The latest Labor Department report showed a gain of 151,000 jobs in February, below forecasts for 170,000.

The report painted a picture of solid hiring in the private sector, with federal government employment declining by 10,000.

But the latest report doesn’t paint a realistic picture, bearing in mind the monthly survey period came before a recent wave of cuts, meaning the following report should reflect a fuller impact.

Mark Cuban flags a coming recession and it is already here for many who have lost their jobs

A recession can often result in volatility in prices.

Unless you are a fly on the wall of Fed policy meetings, timing the market is extremely difficult in a market that depends on whether the Fed ditches QT and restarts QE, providing liquidity to markets. Those who invest at a market bottom during a recession tend to lead to excellent returns.

Want the latest investor news as it happens?

Subscribe to our Investors Newsletter